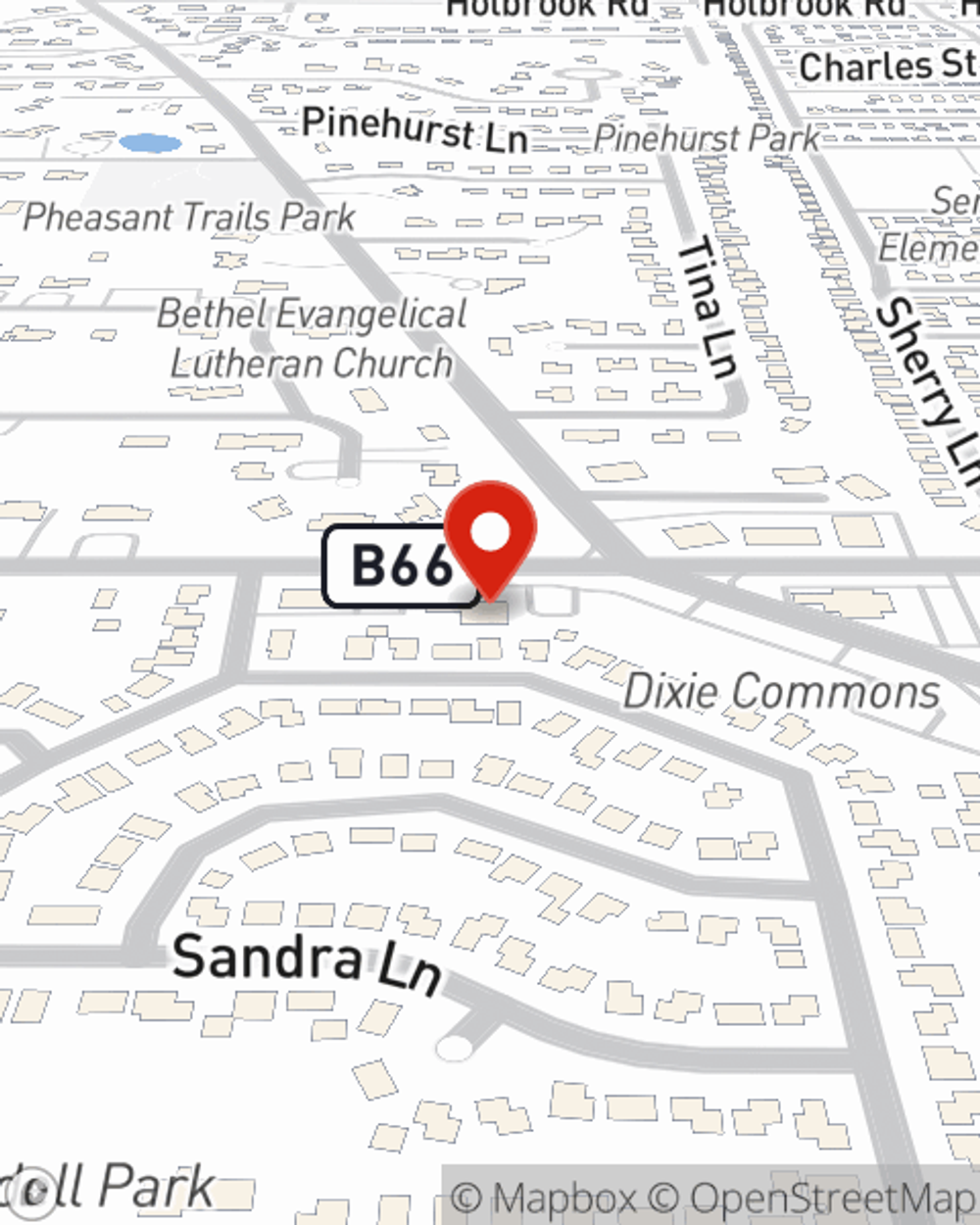

Condo Insurance in and around Chicago Heights

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Your Search For Condo Insurance Ends With State Farm

Often, your safe place is where you are most able to recharge and enjoy your favorite people. That's one reason why your condo means so much to you.

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Agent Derrick Jones, At Your Service

Home is where your heart is. You need condo unitowners coverage to keep it safe! You’ll get that with Condominium Unitowners Insurance from State Farm, a trusted provider of condo unitowners insurance. Derrick Jones is your dependable State Farm Agent who can present coverage options to see which one fits your particular needs. Derrick Jones can walk you through the whole coverage process, step by step. You can have a straightforward experience to get coverage options for everything that's meaningful to you. We’re talking about more than just protection for your swing sets, furniture and electronics. You'll want to protect your family keepsakes—like mementos and souvenirs. And don't forget about all you've collected for your hobbies and interests—like cameras and videogame systems. Agent Derrick Jones can also let you know about State Farm’s great savings and coverage options. There are savings if you carry multiple lines of State Farm insurance or have an automatic sprinkler system, and there are plenty of different coverage options, such as personal articles policy and even additional business property.

Ready to learn more? Agent Derrick Jones is also ready to help you discover what customizable condo insurance options work well for you. Call or email today!

Have More Questions About Condo Unitowners Insurance?

Call Derrick at (708) 799-6100 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Derrick Jones

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.